How Much Does a Restaurant POS System Cost?

Have you ever felt overwhelmed by the constant juggling of orders, payments, and inventory, wondering if there’s a better way to manage it all? Finding an efficient solution is essential for the success and peace of mind of your business.

Brilliant POS offers top-of-the-line POS for Restaurants, designed to streamline operations and enhance customer service. Our advanced systems are tailored to meet the unique needs of the restaurant industry, helping you manage orders, payments, and inventory effortlessly. Along with cutting-edge Restaurant POS Software, Brilliant POS provides an intuitive, easy-to-use platform that integrates seamlessly into your business. With our solutions, you can improve efficiency, reduce errors, and ultimately boost your restaurant’s profitability. Let Brilliant POS elevate your dining experience today!

When running a business, managing orders, payments, and inventory efficiently is crucial. A POS system automates these tasks, making operations smoother and more reliable. It combines both hardware and software to create a seamless experience for you and your customers.

Investing in a POS system involves understanding its cost components. These typically include one-time hardware expenses, monthly software subscriptions, and transaction fees. Each element plays a role in the overall investment, so it’s essential to break them down.

Hardware costs can vary widely, depending on the tools you need, such as touchscreen terminals or card readers. Software fees often come as recurring payments, ensuring you have access to updates and support. Additionally, payment processing fees are tied to each transaction, which can add up over time.

Before making a decision, it’s important to evaluate every aspect of the system. This ensures you choose a solution that fits your needs and budget. In the following sections, we’ll dive deeper into these components to help you make an informed choice.

Introduction to Restaurant POS Cost

Making informed decisions about your business tools starts with knowing their costs. A POS system is a vital tool for streamlining operations, from order management to payment processing. Understanding its expenses ensures you choose a solution that fits your needs and budget.

These systems combine hardware and software to create a seamless experience. Hardware includes devices like terminals and printers, while software handles tasks like inventory tracking and sales reporting. Together, they form the backbone of efficient operations.

Pricing models vary, offering flexibility for different business needs. You can opt for a one-time purchase, monthly subscriptions, or pay-per-use plans. Each model has its advantages, so it’s important to evaluate which aligns with your goals.

In this guide, we’ll break down all major cost components. From hardware to software fees, you’ll gain a clear understanding of what to expect. This knowledge will help you make a smart investment for your business.

Breaking Down POS System Costs

Breaking down costs helps you choose the right solution for your operations. A system like this involves three main expenses: hardware, software, and payment processing fees. Each plays a role in your overall investment.

Hardware includes devices like terminals and card readers. Software covers tools for managing orders and inventory. Payment processing fees, however, are often the most overlooked yet significant expense.

These fees are applied per transaction, typically ranging from 1.5% to 3.5%. They can add up quickly, especially if your business handles a high volume of card payments. Providers vary widely in their rates, so it’s crucial to compare options.

For example, some charge higher fees for credit card transactions but offer discounts for cash payments. Others include additional service fees. These variations directly impact your profit margins.

When evaluating pricing models, consider how transaction fees interact with monthly subscriptions. Some plans may seem affordable upfront but include hidden costs. Always read the fine print to avoid surprises.

By understanding these cost elements, you can make a smarter investment. Compare providers, analyze their fee structures, and choose a solution that aligns with your business goals.

Hardware Costs for Your Restaurant POS System

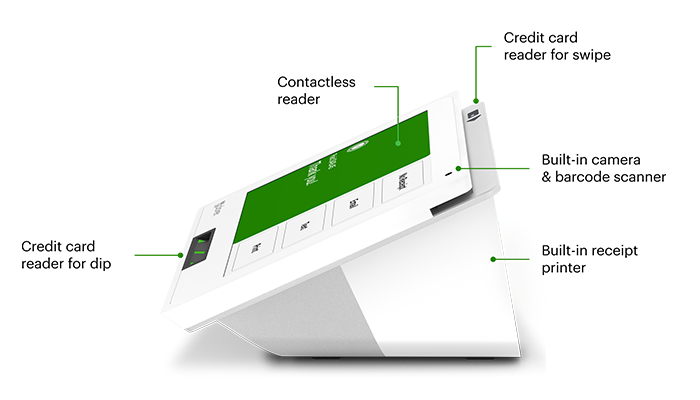

The foundation of any efficient operation lies in its hardware components. For a smooth experience, you’ll need devices like terminals, receipt printers, and cash drawers. These tools work together to ensure your system runs seamlessly.

Terminals can range from $300 to $2,500, depending on features and quality. Receipt printers typically cost between $150 and $500, while cash drawers add another $100 to $300 to your budget. High-quality hardware not only lasts longer but also enhances overall performance.

Some providers bundle installation and maintenance support with their hardware packages. This can save you time and ensure your system is set up correctly. Always check what’s included before making a purchase.

When comparing options, consider modern cloud-based or tablet solutions versus legacy systems. Modern hardware often integrates better with software, offering more flexibility and scalability. Legacy systems, while reliable, may require additional investments in the long run.

Understanding these costs is crucial for budgeting effectively. By investing in the right hardware, you’ll create a solid foundation for your operations. Pairing it with reliable pos software ensures a seamless experience for both you and your customers.

Software Costs and POS Subscription Models

The software component is the backbone of any efficient operation. It powers essential features like inventory control, sales reporting, and customer management. Without it, even the best hardware would fall short of delivering a seamless experience.

Cloud-based systems are a popular choice for their flexibility and accessibility. They offer automatic updates, ensuring you always have the latest features. Plus, you can access your data from anywhere, making it easier to manage your business on the go.

Most systems charge monthly fees for their software subscriptions. These plans often include support, updates, and access to advanced tools. While costs vary, they typically align with the features and scalability you need.

Common features in software packages include inventory tracking, CRM tools, and detailed reporting. These tools help you streamline operations and make data-driven decisions. Some systems even integrate with receipt printers and other hardware for a unified setup.

Different subscription models are available to match your business size and goals. Whether you’re a small operation or a growing enterprise, there’s a plan that fits. Understanding your needs is key to choosing the right one.

By focusing on the software side, you’ll unlock the full potential of your system. It’s not just about the tools—it’s about how they work together to drive your success.

Understanding Payment Processing Fees

Understanding how payment processing fees work is essential for managing your finances effectively. These fees are applied to every sale, typically ranging from 1.5% to 3.5% per transaction. They can significantly impact your profit margins, especially if your business handles a high volume of card payments.

Fees can fluctuate based on the type of card used and the size of the transaction. For example, credit card transactions often incur higher fees than debit cards. Larger transactions may also attract additional charges. Being aware of these variations helps you plan better and avoid unexpected costs.

The relationship between your overall sales volume and processing fees is crucial. Higher transaction volumes can sometimes lead to lower rates, as providers may offer discounts for bulk processing. Efficient management of these fees can positively affect your bottom line.

Comparing providers is key to finding competitive rates. Some charge higher fees but offer additional services, while others focus on affordability. Always read the fine print to understand the full cost structure. This ensures you choose a provider that aligns with your financial goals.

While the details of payment processing fees matter, the ultimate goal is to optimize your financial outcomes. By understanding these costs and comparing options, you can make smarter decisions for your business. This approach not only saves money but also enhances your overall management strategy.

Installation and Setup: Getting Your POS Up and Running

Getting your system up and running quickly is key to smooth operations. Modern solutions often feature plug-and-play designs, making installation straightforward. This minimizes downtime and ensures you can start processing orders efficiently.

For simpler setups, DIY installation is a cost-effective option. Many systems come with detailed guides, allowing you to handle the process without professional help. This approach saves money and gives you full control over the setup.

However, complex configurations may require professional assistance. While this adds to the initial expense, it ensures everything is installed correctly. Proper setup reduces future downtime and ensures robust support for your operations.

Training your staff during the setup process is equally important. A well-trained team can maximize the system’s potential from day one. This includes understanding features like loyalty programs and advanced order management tools.

Investing time in a smooth installation pays off in the long run. It ensures your system operates seamlessly, supporting your business goals. Whether you choose DIY or professional help, focus on creating a foundation for success.

Enhancing Operational Efficiency with Your POS

Streamlining operations is essential for any business aiming to enhance efficiency and customer satisfaction. A well-integrated display system can transform how you manage orders and communicate with your team. By providing real-time updates, it ensures smoother workflows and reduces wait times.

Real-time display systems are particularly valuable during busy periods. They allow staff to track order statuses instantly, minimizing delays and improving accuracy. This is especially useful in high-pressure environments where every second counts.

In the kitchen, a kitchen display plays a critical role in improving communication. It ensures that orders are processed correctly and delivered on time. This reduces errors and enhances accountability among team members, leading to better overall performance.

Modern display systems also support inventory tracking and customer service. By providing up-to-date information, they help you manage stock levels effectively and respond to customer needs promptly. This not only improves efficiency but also boosts profitability.

Investing in a reliable display system is key to optimizing your operations. It streamlines processes, reduces errors, and enhances customer satisfaction. By focusing on operational efficiency, you can create a more productive and profitable business environment.

Integrating Add-On Features and Third-Party Tools

Expanding your system’s capabilities through add-ons can transform how you manage daily tasks. These features extend functionality, allowing you to tailor your setup to meet specific needs. Whether it’s online ordering or inventory tracking, integrations can make your workflow smoother and more efficient.

Third-party tools like kitchen display systems or vendor management software bring added value. They bridge gaps between different systems, creating a seamless environment. For example, integrating an online ordering plugin can reduce manual input and improve accuracy.

While some integrations may incur extra fees, they often drive higher efficiency. Tools like advanced reporting or loyalty programs can enhance customer satisfaction and boost sales. It’s important to evaluate each integration for its ROI and ease of use.

Technology plays a key role in connecting existing systems. APIs and cloud-based solutions ensure smooth data exchange, enhancing overall operation. This reduces errors and saves time, allowing you to focus on growing your business.

Before adding new tools, consider how they align with your goals. A well-integrated system not only improves efficiency but also provides a better experience for your team and customers. By carefully selecting add-ons, you can maximize the value of your setup without unnecessary expenses.

Comparing Legacy, Tablet, and Cloud-Based POS Systems

Selecting the best setup for your business requires understanding the available options. Legacy, tablet, and cloud-based systems each offer distinct features and benefits. Your choice depends on your operational needs, budget, and growth plans.

Legacy systems often involve high upfront costs for hardware and installation. While they may provide robust data security, they lack the flexibility of modern tools. Updates are manual and infrequent, which can limit their adaptability over time.

Tablet and cloud-based solutions, on the other hand, offer lower startup costs and greater ease of use. These systems operate on flexible subscription models, making them ideal for businesses with evolving needs. Automatic updates ensure you always have the latest features without additional effort.

Cloud-based systems stand out for their scalability and accessibility. You can manage operations from anywhere with an internet connection, which is perfect for multi-location businesses. Integration with third-party tools further enhances their functionality.

Each option has its strengths. Legacy systems may suit businesses prioritizing security and stability. Tablet and cloud-based solutions are better for those seeking flexibility and cost efficiency. Evaluating long-term ROI is crucial when making your decision.

Ultimately, the right option aligns with your business size, volume, and growth trajectory. By comparing these systems, you can choose a setup that supports your goals and enhances efficiency.

Restaurant POS Cost: Calculating Monthly Expenses

Managing your monthly expenses effectively starts with understanding the breakdown of your system’s recurring costs. Most systems operate on a subscription model, which includes charges for software, hardware support, and transaction processing. Breaking these down helps you budget smarter.

Start by identifying your monthly subscription fees. These often cover software updates, customer support, and access to advanced features. For example, basic plans may start at $69 per month, while premium options can go up to $399. Always check what’s included to avoid hidden costs.

Next, factor in payment processing fees. These are typically a percentage of each transaction, ranging from 1.5% to 3.5%. If your business handles a high volume of card payments, these fees can add up quickly. Understanding your average sales volume helps predict this expense accurately.

Don’t forget to account for additional costs like maintenance or support fees. Some providers bundle these into their subscriptions, while others charge separately. Comparing providers based on their monthly charges ensures you choose a plan that fits your budget.

By calculating your monthly expenses thoroughly, you can avoid surprises and allocate funds more effectively. This approach not only keeps your finances in check but also ensures your system supports your business goals without unnecessary strain.

Evaluating Security and Data Protection in POS Systems

Protecting sensitive data is a top priority for any business using modern tools. A secure system ensures customer trust and operational efficiency. Without robust measures, your business could face costly breaches and reputational damage.

Common security features include encrypted transactions and secure servers. Encryption ensures that sensitive information, like payment details, remains safe during transfers. Secure servers protect data from unauthorized access, minimizing risks.

Different subscription and pricing models offer varying levels of protection. Premium plans often include advanced security features, while basic options may require additional investments. Choosing the right plan ensures your data is safeguarded without unnecessary expenses.

A well-planned system not only protects customer information but also safeguards operational data. This includes inventory details, sales reports, and employee records. By prioritizing security, you create a foundation for long-term success.

Consider scenarios where security features prevent breaches. For example, encrypted transactions can stop hackers from intercepting payment data. Secure servers ensure that sensitive information remains inaccessible, even during cyberattacks.

Investing in a secure system can save significant costs in the event of a breach. The expenses associated with data loss, legal fees, and reputational damage far outweigh the initial investment. A secure setup is not just a choice—it’s a necessity.

Tips to Maximize ROI with Your POS Investment

Maximizing the value of your investment starts with smart strategies and consistent effort. A well-optimized system can transform your operations, boost efficiency, and drive profitability. Here are actionable tips to ensure you get the most out of your setup.

First, leverage reporting data to identify trends and streamline operations. Regularly analyze sales patterns, inventory levels, and peak hours. This helps you make informed decisions, like adjusting menus or optimizing staff schedules. Data-driven insights are key to staying ahead.

Next, invest in effective staff training. Ensure your team understands all system functionalities, from order processing to inventory tracking. A well-trained team reduces errors, speeds up service, and enhances the overall customer experience. Consider refresher courses to keep skills sharp.

Enhance customer engagement through integrated loyalty programs. Reward repeat visitors with discounts or special offers. This not only builds loyalty but also gathers valuable data for personalized marketing. A satisfied customer is more likely to return and recommend your business.

Finally, conduct periodic reviews of your system’s performance. Compare metrics like transaction speed, error rates, and customer feedback. Use this information to make targeted improvements. Continuous optimization ensures your setup evolves with your business needs.

By focusing on these strategies, you can maximize your ROI and create a more efficient, profitable operation. Smart investments today lead to long-term success tomorrow.

Utilizing Advanced Analytics for Business Growth

Harnessing the power of advanced analytics can unlock new opportunities for your business growth. By integrating real-time data into your operations, you gain actionable insights that drive efficiency and profitability. This approach transforms how you manage cash flow, optimize inventory, and schedule staff.

Advanced analytics tools provide detailed reports on sales trends, customer behavior, and peak hours. For example, you can identify which items are most profitable and adjust your offerings accordingly. This ensures your cash drawer stays balanced while reducing waste and improving margins.

Real-time data also plays a crucial role in managing time effectively. By analyzing busy periods, you can optimize staffing levels to meet demand without overspending. This not only improves operational efficiency but also enhances the customer experience.

Predictive analytics takes this a step further by forecasting future trends. Tools like sales trend analysis help you anticipate customer preferences and adjust your strategy proactively. This ensures you’re always one step ahead in a competitive market.

With timely access to reports, you can make swift, informed decisions. Whether it’s adjusting inventory levels or launching targeted promotions, data-driven insights empower you to act with confidence. This approach maximizes your ROI and sets the stage for sustained growth.

By leveraging advanced analytics, you create a more efficient, profitable operation. From managing cash flow to optimizing time, these tools provide the insights you need to thrive. Start harnessing the power of data today and watch your business reach new heights.

Streamlining Operations with Technology Integrations

Integrating technology into your operations can transform how you manage daily tasks. By aligning tools with your system, you simplify workflows and reduce manual effort. This approach not only saves time but also enhances overall efficiency.

One major benefit is improved order accuracy. Tools like kitchen display systems ensure that orders are processed correctly, reducing errors and speeding up fulfillment. This leads to better customer experiences and smoother operations.

Another advantage is streamlined communication between teams. Integrating systems for inventory management and accounting ensures everyone is on the same page. This reduces misunderstandings and enhances collaboration, especially during busy periods.

Technology integrations also minimize human error. Automated processes handle repetitive tasks, freeing up your team to focus on more critical activities. This not only boosts productivity but also ensures consistency in your operations.

In today’s dynamic industry, staying competitive requires leveraging the latest tools. Researching compatibility when adding new integrations ensures seamless implementation. This approach helps you stay ahead while maximizing the value of your investments.

By embracing technology, you create a more efficient and profitable operation. Whether it’s improving order accuracy or enhancing team communication, these integrations are essential for long-term success.

Final Considerations for Your Restaurant POS Decision

Choosing the right tools for your business requires careful consideration of both immediate and long-term needs. From hardware to monthly fees, understanding all cost factors ensures you make a well-informed investment. This approach not only saves money but also enhances operational efficiency.

Start by aligning your business needs with the features offered. Evaluate whether the system supports your growth goals and daily operations. A solution that scales with your sale volume ensures long-term value.

Don’t overlook the importance of training and data security. A well-trained team maximizes system potential, while robust security measures protect sensitive information. These elements are crucial for maintaining trust and efficiency.

Finally, consider solutions like Brilliant POS, which are designed to address many of these challenges. By focusing on flexibility, support, and scalability, such tools can simplify your decision-making process and drive profitability.

Taking the time to evaluate all aspects ensures your investment pays off. With the right system in place, you’ll create a foundation for sustained success and growth.

Conclusion

Making the right choice for your business tools ensures smoother operations and better financial outcomes. Throughout this guide, we’ve explored the key components of expenses, from hardware and software to monthly fees and payment processing. Understanding these elements helps you make informed decisions that align with your goals.

Careful planning of your system’s costs can significantly impact your success. By analyzing each expense, you can avoid surprises and allocate resources effectively. Tools like advanced analytics and loyalty programs further enhance efficiency and customer satisfaction.

When evaluating options, consider solutions like Brilliant POS. Its comprehensive service and scalability can streamline your operations while supporting cost management. Taking the time to assess all factors ensures your investment drives long-term growth.